The Foundation’s goal is to grow its endowment by maximizing investment returns while preserving the principal. The Foundation’s investment objectives respond to changes in the economic environment, market conditions and other considerations.

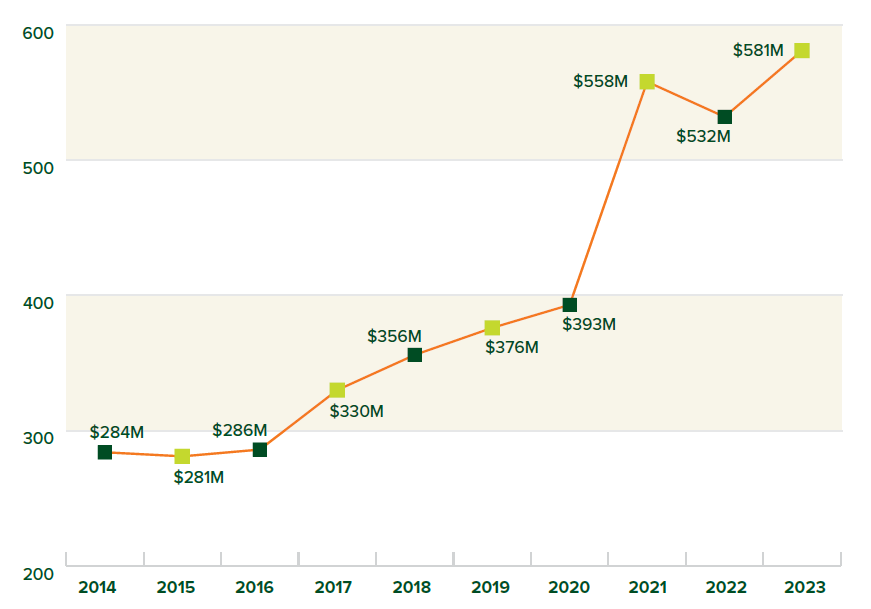

Fiscal Year 2023 Endowment Growth

Total Endowment Value: $580,576,895

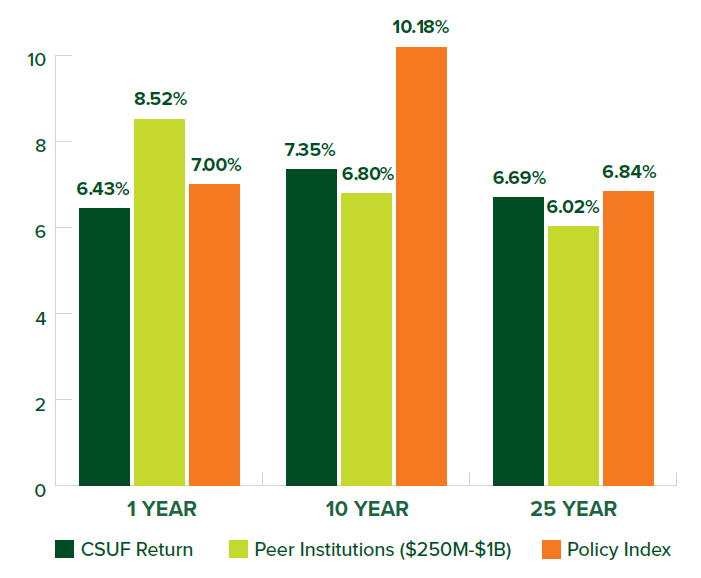

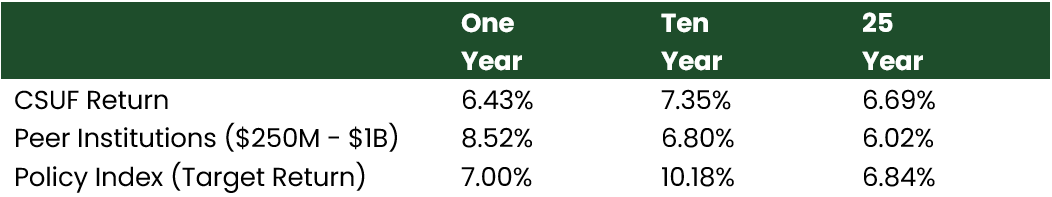

Fiscal Year 2023 Investment Performance

To preserve the value of the endowment, investment returns in excess of the distribution and the administrative fees are reinvested to the endowment annually. Since CSU Foundation’s founding in 1970, returns on endowed assets have averaged 8.53%.

Target Asset Allocations

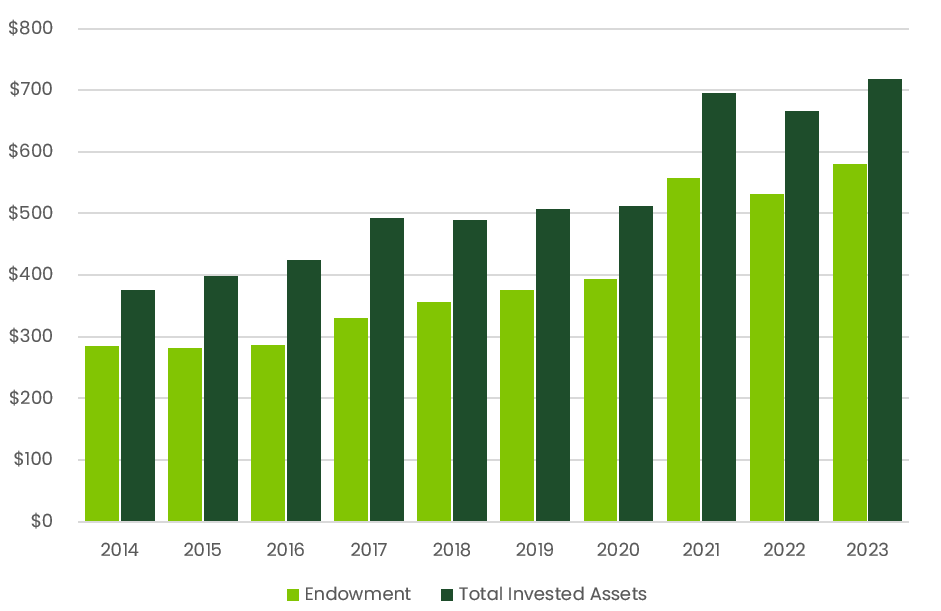

Total Invested Assets vs. Endowment

(in millions by fiscal year)

The Foundation’s endowment has grown from $284 million in fiscal year 2014 to $580 million in fiscal year 2023.

Total invested assets have increased from $375 million in fiscal year 2014 to $717 million in fiscal year 2023.

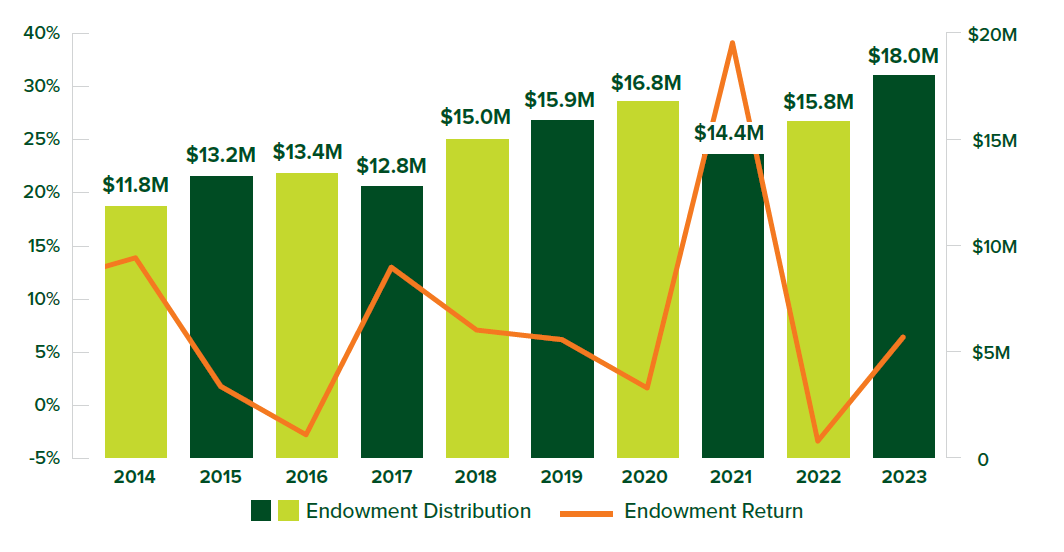

Endowment Returns Made Available for Spending

Distributions from the endowment to CSU continue to increase. This growth is due to donors’ generous contributions and the Foundation’s prudent stewardship. CSUF’s board proactively implemented the use of a three-year rolling average calculation in 2021 to reduce the impact of market volatility and provide greater stability to the funds available to the University.

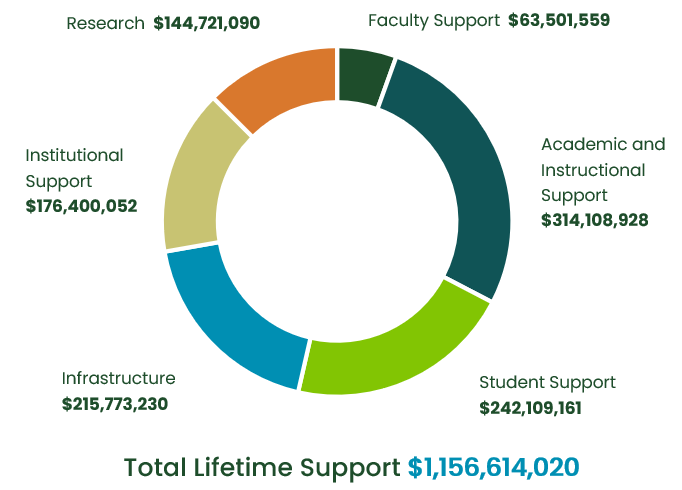

Lifetime Support